Are you a Kenyan citizen, business owner, or foreign resident looking to get a KRA PIN? The Kenya Revenue Authority (KRA) requires all taxpayers to have a Personal Identification Number (PIN) for tax transactions. PIN is also needed for other activities listed here in this article.

Affiliate Disclosure: This post may contain affiliate links – I may receive a small commission if you purchase through links, at no extra cost to you. Read HERE.

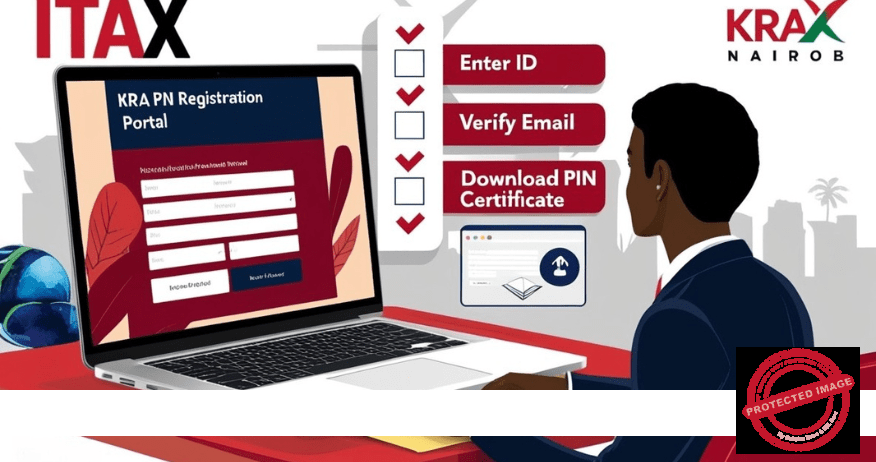

To get the KRA PIN, the only way is to register through iTax, which is the KRA’s online platform for tax-related services.

In this article, we will walk you through the steps to help you seamlessly register for a KRA PIN online on iTax and download a copy of your PIN certificate.

What is a KRA PIN and Why Do You Need It?

A KRA PIN is a unique number issued by the KRA for tax purposes. It is required for:

- Filing tax returns on iTax

- Opening a bank account

- Buying or selling land

- Applying for business permits

- Accessing government services

Without a valid KRA PIN, you cannot complete many financial and legal transactions in Kenya

Who Needs to Register for a KRA PIN?

You need to register for a KRA PIN if you fall under any of these categories:

- Kenyan citizens above 18 years with an ID card

- Foreign residents working or doing business in Kenya

- Business owners who must comply with tax laws

- Students applying for HELB loans

- Employees required to pay Pay As You Earn (PAYE)

Now that you know why a KRA PIN is important, let us move on to the registration process on iTax. To register for PIN, you must be able to log into iTax. That means you will need a phone or a computer and access to the internet.

In the following sections, we detail 9 steps that will enable you to register for a KRA PIN and download a copy of the PIN certificate.

How to Register for a KRA PIN Online on iTax - Step-by-Step

The following are the steps you can follow to register for the KRA PIN omline. Note that you can only apply for a PIN online, you can not do it manually.

Step 1: Visit the iTax Portal

To start your KRA PIN registration process, follow these steps:

- Open your web browser and go to iTax

- Click on “New PIN Registration” space.

Step 2: Select Taxpayer Type

You will see space for your taxpayer type. There are two types of taxpayers. Choose the correct option:

- Individual (For personal PINs)

- Non-Individual – For non-individual taxpayers (companies, NGOs, partnerships, etc.)

If you are registering for personal tax purposes, select Individual and proceed. If you are registering for non-individual tax purposes, select Non-individual and proceed.

Step 3: Enter Your National ID Details

For Kenyan citizens, you will need to:

- Enter your National ID card number. A passport is no longer allowed.

- Confirm your date of birth.

The system will automatically verify your the registration details you have provided with government records. The national ID card is issued by the government.

If you are a foreign resident, enter your Passport Number or Alien ID number.

Step 4: Provide Basic Personal Information

In the next section, you will now fill in your personal details, including:

- Full Name

- Date of Birth

- Email Address

- Phone Number

Make sure the email and phone number are correct. KRA will use them for verification and any future communication.

It is important to make sure you have access to the email that you are providing. In case you change either your email or phone number, inform KRA. You will be assisted to make the changes for your PIN.

Step 5: Choose Your Tax Obligation

The next step is selecting the tax obligation applicable to you. Options include:

- Income Tax – Resident (for Kenyan citizens earning an income)

- Income Tax – Non-Resident (for foreigners working in Kenya)

- VAT (Value Added Tax) (for businesses registered for VAT)

- PAYE (for Employers)

Most individuals will choose Income Tax – Resident unless they have additional tax obligations. Your source of income will determine your tax obligations. Also, turnover thresholds, for example, taxes that require thresholds like VAT, will need the necessary qualifications.

Step 6: Select Your Source of Income

KRA will ask where you earn your money from. Choose one of the following:

- Employment (if you have a job)

- Business (if you run a business)

- Rental Income (if you earn from rental property)

- Other Income

If you are a student, you can select None of the above. It is important to note that Kenyan citizens report on their worldwide income.

Step 7: Set Up Your iTax Login Credentials

Once you fill in your details, the system will generate:

- Your KRA PIN

- Your iTax username (same as your KRA PIN)

- A temporary password will be sent to your email

Step 8: Activate Your iTax Account

The next things that you will need to do are the following:

- Check your email for the temporary password from KRA.

- Go back to the iTax login page.

- Enter your KRA PIN as the username.

- Use the temporary password to log in.

- Change your password to a new, secure one.

Step 9: Download Your KRA PIN Certificate

Once your account is set up, you can now download your KRA PIN certificate:

- Go to iTax and log in.

- Click “Registration” > “Reprint PIN Certificate.”

- Download and save your KRA PIN Certificate as a PDF on your computer. You can also send yourself an email.

Your KRA PIN registration on iTax is now complete!

FAQs About KRA PIN Registration on iTax

1. How long does it take to get a KRA PIN?

It takes less than 10 minutes if you follow the online registration steps correctly. However, if iTax is not performing optimally, this will take a longer time.

2. Can I register for a KRA PIN if I don’t have a job?

Yes! Even if you are a student or unemployed, you can still register on iTax. Apart from paying tax, you also need the PIN for other activities listed above.

- What should I do if I forget my iTax password?

Go to the iTax login page, click “Forgot Password”, and follow the reset steps.

- Can I change my email or phone number on iTax?

Yes. Log into your iTax account, go to “Update PIN Details”, and update your contact information. If you cannot do it, get in touch with KRA – customer care section.

- Do I need to file tax returns after getting a KRA PIN?

Yes! Even if you do not have any income, it is a requirement to file Nil Returns for every tax period—months or years—to avoid fines, penalties, and interests.

Other Related Posts

Final Thoughts

Registering for a KRA PIN on iTax is an easy process that takes just a few minutes. Whether you need the PIN for employment, business, or personal use, having a KRA PIN is essential for financial and legal transactions in Kenya.

By following these nine steps, you can register your KRA PIN online without any hassle. Make sure to activate your iTax account, keep your PIN certificate safe, and always file your tax returns on time.

Need Help with iTax?

If you experience any issues, visit the KRA Help Center or contact KRA Customer Support for assistance.

KRA Contact on: +254 20 4 999 999 or +254 711 099 999 OR KRA Email on: callcentre@kra.go.ke

Now that you know how to register for a KRA PIN online on iTax, share this article with anyone who may need help!