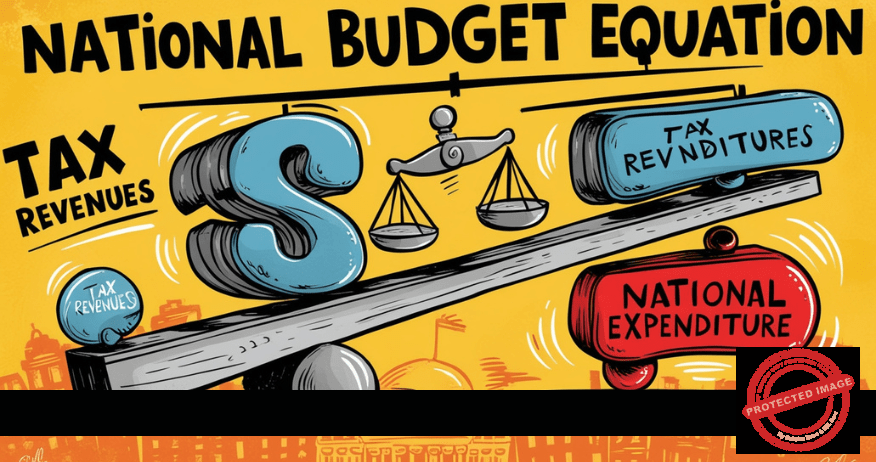

What is a national budget equation? Across the globe, many people wonder. In every financial year, the Kenya government presents the national budget.

The national budget is a guide to the government on the revenue rising efforts and expenditure. The government endeavours to have a balanced budget where revenues fully fund the expenditures. This ensures continued uninterrupted economic growth in the country.

However, it is preferred that the revenues collected in any government financial year be more than the expenditure.

a) Government Expenditures

Government expenditure is the use the government puts the revenues into. The government expenditures are mainly two in the form of:

Development projects

These long-term expenditures that may cover various financial years. Development expenditures often require huge amounts of revenues, take time to complete, the returns may not be immediate but they are long term. Some examples of development expenditures are infrastructure projects such as roads, schools, hospitals, etc.

Recurrent expenditures

Recurrent expenditures are expenditures that are normally utilized within the government’s financial years. The expenditures recur mostly every month. On a per-project basis, recurrent expenditures do not require as much revenue investments as development expenditures.

Returns from current expenditures are almost immediate but are not long-lasting. For the same benefit, the government keeps reinvesting in the expenditure. Some examples of recurrent expenditures are salaries (for doctors, administrators, security agencies, teachers), governance, consumption expenses, e.g. stationery.

b) Government Revenues

Government revenue is the revenue that is collected by the government in one financial year to run its operations. The two main sources of government revenues are:

Tax revenue sources

Tax revenues are generated from tax sources. Broadly, there are two types of taxes:

- Direct taxes that are paid by the person on whom they are imposed. Example are taxed from earned income, e.g. PAYE, corporate income tax.

- Indirect taxes that are paid on behalf of the person on whom they are imposed, for example taxes on consumption, e.g. excise duty, VAT.

Non-tax sources

Governments also have revenues from sources that are not tax-related. The sources can be categorized into two:

- Local sources such as local borrowings from the domestic markets, fines (on the road), sale of assets (privatization) etc.

- International sources such as borrowings from other governments and commercial banks, grants, donations, etc.

Comparing the two sources of government revenues, tax sources are cheaper. There are several reasons for this, such as:

- The government has control over taxes – tax rates can be increased or decreased without consulting the people.

- Tax collection costs are within the government’s control.

- Tax revenues are collected throughout the year.

- Other sources of revenue, such as the sale of assets, are one-off activities best suited for paying debts and onetime investments.

Therefore, the government must mobilize adequate revenues locally and internationally to finance development and recurrent expenditures during any financial year. However, sometimes, the revenue expenditure equation does not balance.

Unbalanced Equation

Governments are expected to operate balanced budgets where the revenues should at least be equal to the expenditures. However, the budget is either in deficit or surplus.

a) Budget Deficit

In most financial years, government expenditures are more than the revenues. This situation is occasioned by two situations:

i. Expenditures remain the same, but revenues decrease

Governments work with expected revenues. Sometimes, the revenues collected may decrease, especially in cases where the government fails to collect the projected revenues. This can be attributed to various reasons, such as:

- Government over-projection of expected revenues.

- Increased incidences of tax evasion and tax avoidance.

- Change in tax policies (removal of some items from the tax bracket) etc.

ii. Expenditures increase while revenues remain the same

The projected expenditures may increase due to unforeseen circumstances. Expenditures are based on the projected number of units and unit prices. Changes in the projected expenditures may result from:

- Increased expenditures due to the increased number of units required. This may result from under-budgeting, where the actual units are more than the budgeted units.

- Inflation resulting in increased prices of goods and services.

- Unexpected expenditures, such as in cases of natural calamities like drought, floods.

How are budget deficits financed?

Governments have various options to finance budget deficits. The government can fund the budget deficit through:

- Increasing various tax rates in efforts to collect more taxes.

- Local borrowing by issuing treasury bills, bonds (local and international) and other type of loans (domestic and international) etc.

- Sale of government assets such as buildings, businesses, land, etc.

- International borrowing from other governments and commercial banks.

- International appeals for donations from governments and wealthy individuals.

b) Budget Surplus

Sometimes, in a financial year, the revenues are more than the expenditures. Hence, the government has extra revenues to utilize in the next financial year. Budget surplus may result from:

i. Revenues increases while expenditures remain the same

The revenue amount collected during a financial year may increase when there is an increase in either the tax sources or non-tax sources or on both.

The increase from the tax sources may result from widening the tax base, increase in tax rates, increased efficiency in tax collection by the tax administration, increased confidence in the government by the population, reduced cases of tax evasion and avoidance, etc.

The increase from non-tax sources may result from local sources such as the sale of assets, through privatization programs, more fines, change in government policy (e.g. increased license fees), increased donations by foreign donors, etc.

ii. Revenues remain the same while expenditures decrease

Expenditures are normally composed of the number of units and unit prices. The number of units required can reduce or the prices can reduce. The number of units can decrease due to changes in government policy or because of previous over-budgeting.

Governments are expected to operate balanced budgets where the revenues should at least be equal to the expenditures. However, the budget is either in deficit or surplus.

a) Budget Deficit

In most financial years, government expenditures are more than the revenues. This situation is occasioned by two situations:

i. Expenditures remain the same, but revenues decrease

Governments work with expected revenues. Sometimes, the revenues collected may decrease, especially in cases where the government fails to collect the projected revenues. This can be attributed to various reasons, such as:

- Government over-projection of expected revenues.

- Increased incidences of tax evasion and tax avoidance.

- Change in tax policies (removal of some items from the tax bracket) etc.

ii. Expenditures increase while revenues remain the same

The projected expenditures may increase due to unforeseen circumstances. Expenditures are based on the projected number of units and unit prices. Changes in the projected expenditures may result from:

- Increased expenditures due to the increased number of units required. This may result from under-budgeting, where the actual units are more than the budgeted units.

- Inflation resulting in increased prices of goods and services.

- Unexpected expenditures, such as in cases of natural calamities like drought, floods.

How are budget deficits financed?

Governments have various options to finance budget deficits. The government can fund the budget deficit through:

- Increasing various tax rates in efforts to collect more taxes.

- Local borrowing by issuing treasury bills, bonds (local and international) and other type of loans (domestic and international) etc.

- Sale of government assets such as buildings, businesses, land, etc.

- International borrowing from other governments and commercial banks.

- International appeals for donations from governments and wealthy individuals.

b) Budget Surplus

Sometimes, in a financial year, the revenues are more than the expenditures. Hence, the government has extra revenues to utilize in the next financial year. Budget surplus may result from:

i. Revenues increase while expenditures remain the same

The revenue amount collected during a financial year may increase when there is an increase in either the tax sources or non-tax sources or on both.

The increase from the tax sources may result from widening the tax base, increase in tax rates, increased efficiency in tax collection by the tax administration, increased confidence in the government by the population, reduced cases of tax evasion and avoidance, etc.

The increase from non-tax sources may result from local sources such as the sale of assets, through privatization programs, more fines, change in government policy (e.g. increased license fees), increased donations by foreign donors, etc.

ii. Revenues remain the same while expenditures decrease

Expenditures are normally composed of the number of units and unit prices. The number of units required can reduce or the prices can reduce. The number of units can decrease due to changes in government policy or because of previous over-budgeting.

Also, the prices can change because of deflation in the economy where there is a general downward movement in prices in the market, general market forces where there is an increased supply of products that the government is procuring, thus reducing the prices.

In conclusion, for the Kenya budget equation to balance, the government must have revenues that adequately fund the expenditures in every financial year.

Also, the prices can change because of deflation in the economy where there is a general downward movement in prices in the market, general market forces where there is an increased supply of products that the government is procuring, thus reducing the prices.

In conclusion, for the Kenya budget equation to balance, the government must have revenues that adequately fund the expenditures in every financial year.

Remember to subscribe to receive articles like this one. Feel free to send us questions or topics on tax and investments in Kenya that you would wish to be covered on this website.

Disclaimer

This post is for general overview and guidance and does not in any way amount to professional advice. Hence, www.taxkenya.com, its owner or associates do not take any responsibility for results of any action taken on the basis of the information in this post or for any errors or omissions. Kenyan taxpayers must always rely on the most current information from the KRA. The tax industry in Kenya is very dynamic.