Many people are unaware that there is a KRA Citizen’s Service Delivery Charter. On 18 December 2018, I received a copy of the Kenya Revenue Authority (KRA) Citizen’s Service Delivery Charter via email.

That surprised me. What was happening to the tax commissioner? Was this a eureka moment where the tax commissioner suddenly realized that taxpayers are clients and are provided services? The experience has always been like ‘that of a supervisor and servants in some plantation fields.’ You have not done this; you suffer from this. It was and still is about taxpayers’ obligations, and listen to this … no rights.

I was skeptical about the service charter. Unfortunately, many years later, most of what was promised did not happen. The intention may have been there, but there was no willingness.

Many other taxpayers also received the Charter. However, some citizens may not have received this Charter—they may not be taxpayers. It is noticeable that this Service Charter was released after our earlier article on Customer Care for Taxpayers in November 2018 on this website.

What is a Citizen’s Service Delivery Charter?

What is a service delivery charter? From various internet sources, a service delivery charter is “a written policy that states an institution’s commitment to serve clients within its mission and compliance with laws and regulations.”

The tax commissioner told me and other taxpayers that they were committed to serving us within the tax commissioner’s mission and in compliance with the country’s laws and regulations.

We commend the tax commissioner for this significant step – it was in the right direction. We hope that everything else will be in the right direction.

In the service charter, there were “rights and privileges and also obligations.” Remember, in taxation, the mantra is “There are no rights and privileges without obligations.” A right is not a privilege. Why was the tax commissioner not ready to discuss citizen rights?

The tax Acts used by the tax commissioner are subordinate to the Kenya Constitution, which is also subordinate to the Universal Declaration of Human Rights, etc. Most of the problems that taxpayers have with the tax commissioner involve violations of taxpayers’ human rights, which are clearly stipulated in the Kenya Constitution, the U.N.’s Universal Declaration of Human Rights, and other documents.

We find it suspicious that the Citizen’s Service Delivery Charter completely omitted taxpayers’ rights. The tax commissioner should not only define the obligations and privileges of all citizens in service delivery as far as taxes are concerned, but must also address taxpayers’ rights.

Again, Kenyan citizens are not the only taxpayers who require the tax commissioner’s services. We have many other people who pay taxes and require the tax commissioner’s services, such as persons working in the country on work permits and companies transacting business with Kenyans. Is the tax commissioner not committed to serving them? We hope a Citizen’s Service Delivery Charter that includes taxpayers’ rights will soon be out.

Taxpayers remit taxes to the government while the government receives the taxes.

The tax commissioner is a corporate body responsible for collecting taxes on behalf of the government, and it is paid a commission for this work. Collecting taxes involves implementing tax laws and ensuring taxpayers submit tax returns and remit the correct amount of tax at the right time.

To successfully fulfil its mandate, the tax commissioner offers various services to taxpayers. In receiving these services, taxpayers have rights, privileges, and obligations.

The tax commissioner does not provide the rights and privileges that the taxpayers enjoy.

However, the taxpayers fulfil the obligations. This Service Charter should be about the rights and privileges enjoyed by taxpayers and their obligations.

Contents of the Service Charter

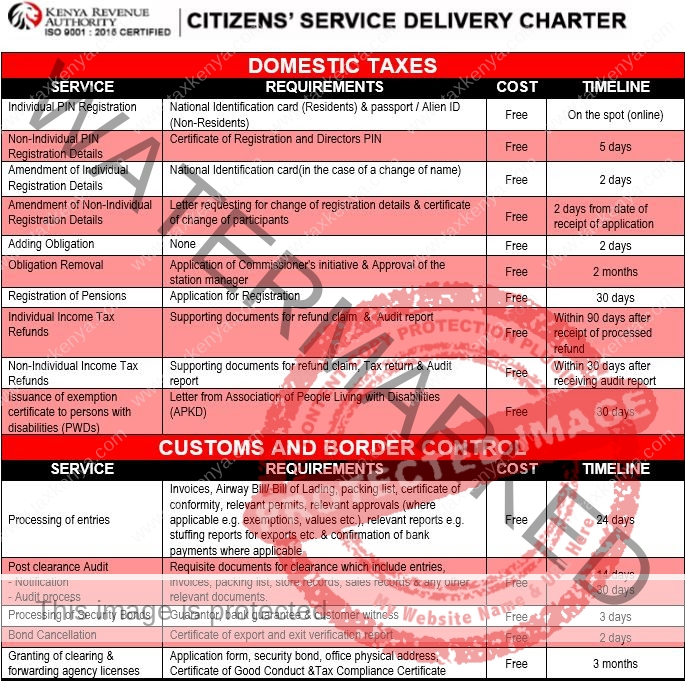

This Service Charter covers services under Domestic Taxes and Customs and Border Control. The Service Charter sets out:

- The requirements to access the services are mainly documents.

- The cost of the services.

- The time it should take for the services to be delivered.

a. Domestic Taxes

Under Domestic Taxes, the Service Charter covers services in eight areas:

- Personal Identification Number (PIN) for individuals.

- PIN for non-individuals.

- Amendment of registration details.

- Obligation removal from PIN.

- Registration of Pensions.

- Income tax refunds – individuals.

- Income tax refunds – non-individuals.

- Exemption certificates to persons with disabilities.

b. Customs and Border Control

Under the Customs and Border Control, the Charter covers services in five areas:

- Processing of entries – imports and exports.

- Post clearance audits – notification for all imports and the audit process.

- Processing of security bonds – bank guarantee, guarantor, and customer witnesses.

- Bond cancellations – exit verification report and certificate of export (COE).

- Granting of clearing and forwarding agency licenses.

c. Access to Information

The Service Charter assures taxpayers their right to access information about their affairs under all the taxes the tax commissioner administers. Taxpayers should note this.

d. Complaints

Further, the Service Charter sets out the process to lodge any complaints where a taxpayer’s complaints are not addressed satisfactorily. The steps are:

- Step 1: Go in person to the nearest tax station, email cellcentre@kra.go.ke, or phone 020 4 999 999/+254-0711 099 999.

- Step 2: Complaint Information Centre – email cic@kra.go.ke or telephone 020 281 7700/7800

- Step 3: The Commissioner General: email cg@kra.go.ke, P.O. Box 48240-00100, Nairobi.

- Step 4: Office of the Ombudsman: email complain@ombudsman.go.ke, P.O. Box 48240-00100, Nairobi.

It should be noted that in this Service Charter, the Commissioner General and Office of the Ombudsman share the same postal address. The Commission on Administrative Justice-Office of the Ombudsman is a Constitutional Commission Established under Article 59(4) of the Constitution and the Commission on Administrative Justice Act, 2011.

Taxpayers are expected to complain to the Office of the Ombudsman, which is expected to be impartial. However, when the Commissioner General and Office of the Ombudsman share the same postal address, impartiality goes out the window. We only hope this is an error that will be corrected with time.

When is the Service Charter Used?

All taxpayers need to read the Service Charter and keep a copy for future reference. The Service Charter is a public commitment by the tax commissioner to Kenyan citizens. It is often used to determine tax disputes.

For example, suppose a taxpayer has applied for the removal of obligations, such as VAT, and has submitted all the requisite documents. In that case, the tax commissioner has committed to removing the VAT obligation within two months.

Suppose the taxpayer cannot submit a tax return in the third month after applying for removal of the obligation. In that case, they should refrain from paying any penalties or interest resulting from their continued VAT registration.

This Service Charter is important because it provides taxpayers with rights and privileges and points out obligations that can be enforced in any Court of Law. However, the lists in the Service Charter still need to be completed, since many other taxpayers’ rights and privileges are in the Tax Acts that the tax commissioner administers.

The Service Charter Received

The following is the Citizen’s Service Delivery Charter put out by the tax commissioner in December 2018. Note that this is a public document. Read and keep a copy.

Conclusion

A service charter is an important document that can help taxpayers in disputes with the tax commissioner.

Feel free to send us questions or topics on tax and investments in Kenya that you would wish to be covered in this Website – taxkenya@gmail.com

Disclaimer

This post is for general overview and guidance and does not in any way amount to professional advice. Hence, www.taxkenya.com, its owner or associates do not take any responsibility for results of any action taken on the basis of the information in this post or for any errors or omissions. Kenyan taxpayers must always rely on the most current information from KRA. Tax industry in Kenya is very dynamic.